August 2024 Greater Des Moines Housing Market Update

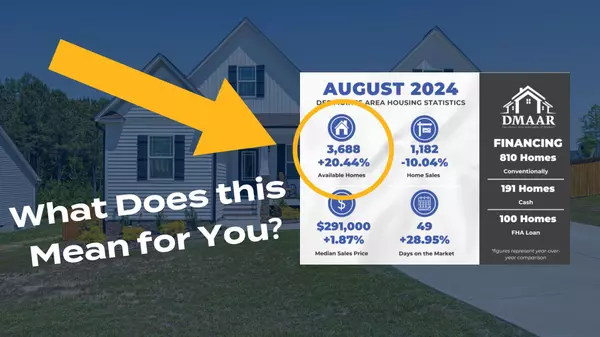

As summer 2024 comes to a close with schools starting up, the Des Moines metro housing market welcomed a drop in mortgage rates, an increase in inventory, and a rise in pending sales with open arms. In this video, we will be sharing the finalized data from August 2024. In comparison to July, Au

How the Federal Reserve’s Next Move Could Impact the Housing Market

Now that it’s September, all eyes are on the Federal Reserve (the Fed). The overwhelming expectation is that they’ll cut the Federal Funds Rate at their upcoming meeting, driven primarily by recent signs that inflation is cooling, and the job market is slowing down. Mark Zandi, Chief Economist a

Are We Heading into a Balanced Market?

If you’ve been keeping an eye on the housing market over the past couple of years, you know sellers have had the upper hand. But is that going to shift now that inventory is growing? Here’s a breakdown of what you need to know. What Is a Balanced Market? A balanced market is generally defined as

Categories

Recent Posts