A Record Percent of Buyers Are Planning To Move in 2025 – Are You?

This could be the year to sell your house – and here’s why. According to a recent NerdWallet survey, 15% of people are planning to buy a home this year. That’s actually a record high for this survey (see graph below): Here's why this is such a big deal. The percentage has been hovering between

When Is the Perfect Time To Move?

It’s easy to get caught up in the idea of waiting for the perfect moment to make your move – especially in today’s market. Maybe you’re holding out and hoping mortgage rates will drop, or that home prices will fall. But here’s what you need to realize: trying to time the market rarely works. And h

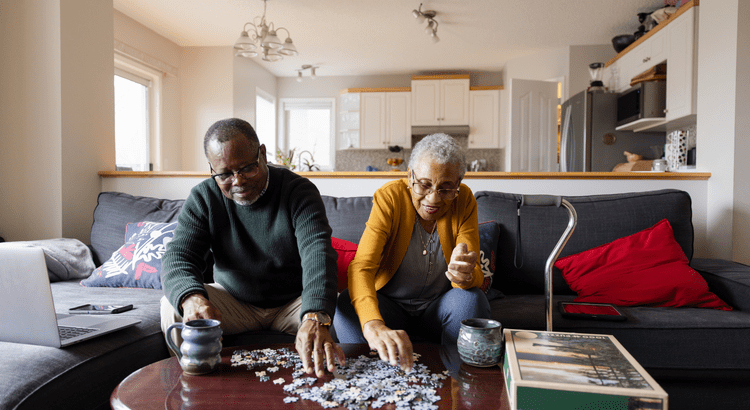

How Home Equity Can Help Fuel Your Retirement

If retirement is on the horizon, now’s the time to start thinking about your next chapter. And you probably want to make sure you’re set up to feel comfortable financially to live the life you want in retirement. What you may not realize is you likely have a hidden goldmine of cash you’re not th

Categories

Recent Posts